MGAs break free from the market cycle as new forces reshape the model

Analysis

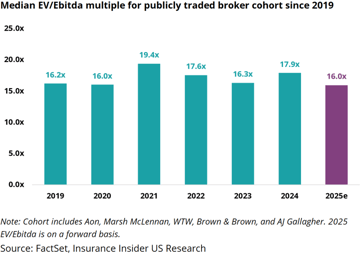

In this sample of our analysis from Insurance Insider, we show how we connect the dots across capital, underwriting behaviour and investor appetite. Here, we unpack how PE‑fuelled equity alignment, tech‑led distribution and shifting valuations have uncoupled MGAs from the traditional market cycle. We turn complexity into clarity by grounding each point in data, such as MGAs increasingly achieving mid‑ to high‑teens Ebitda multiples.

PE, more alignment and tech are uncoupling MGAs from traditional market swings.

MGAs once tracked the market cycle closely, thriving in soft markets as carriers chased growth with minimal investment. But the influx of private equity (PE) capital and other structural changes have taken MGAs into a supercycle where their growth is now in their hands.

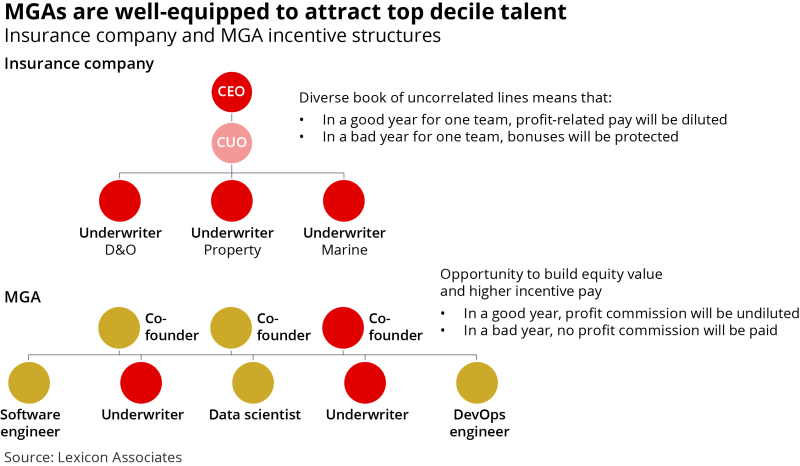

A key catalyst has been the decoupling of underwriting from carrier balance sheets, paired with equity-rich incentive models that continue to draw senior underwriters into the MGA space.

At the same time, modern tech stacks and specialist distribution channels have allowed MGAs to deliver differentiated products and source business that would never reach London through traditional routes.

“We're in a supercycle for MGAs,” a source said. “People have cottoned onto it as an amazing model.”

These dynamics have reshaped the sector into something more resilient and strategically important than in prior cycles. And as the market now softens, those same factors are influencing where reinsurers deploy capacity, how fronting models evolve and how MGA platforms realign their equity structures to sustain growth.

The new economics of the MGA model

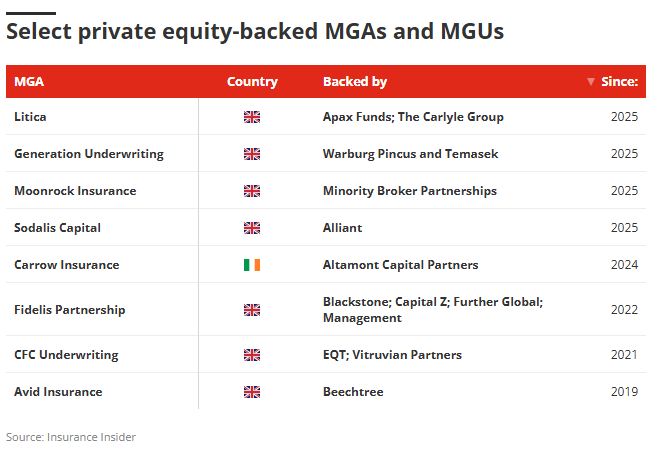

PE has seeped into almost every corner of the MGA ecosystem and is one of the defining forces steering how MGAs are formed, funded and grown and its footprint is still widening.

“PE is just permeating every facet of the business, whether it's third-party administrators, which are owned by PE firms, all the way to the hybrid fronting carriers, to the hosting platforms,” said a source.

The barriers to entry are significant, including regulation, start-up capital and inherent risk which all make launching an MGA difficult, sources said. But once established, the model is light on the balance sheet and highly cash-generative, which makes it especially appealing to PE investors.

Beyond PE, MGAs have become increasingly untethered from traditional market cycles for a mix of structural and strategic reasons, sources said.

First, the market has recognised that that can look beyond a standard MGA model. For example, Fidelis has proved that underwriting doesn’t need to be tied to a carrier’s balance sheet. That shift has encouraged carriers to invest in or support MGAs.

Second, the economics have shifted in a way that makes the MGA model far more attractive to senior underwriting talent. Joining a new MGA now often comes with meaningful equity that can deliver real value on exit – a markedly stronger upside than the limited equity participation typically available at major carriers.

MGAs fetch much higher Ebitda multiples when sold, and valuations in the high teens are increasingly common. For instance, SiriusPoint has agreed to sell health insurance MGA Armada to Ambac at approximately 14x Ebitda in September, and CRC Group is in advanced talks to acquire heavyweight transactional liability specialist MGA Euclid Transactional in the region of 17x Ebitda.

“You've got a balance sheet reward versus an Ebitda reward,” said a source, who added that the choice is clear given the stark difference in valuations between MGAs and carriers.

Differentiation through tech and distribution

MGAs are no longer just “another cab on the rank,” sources added, offering genuine differentiation, particularly through modern technology stacks that set them apart from carriers.

This has enabled them to plug into emerging digital distribution channels, and access risks that wouldn't otherwise come to London, making them more valuable to capacity providers.

And, crucially, MGAs can deploy modern technology to create more usable, attractive products.

From a technology perspective, incumbents with legacy systems are at a real disadvantage. It’s extremely difficult, and in some cases nearly impossible, to modernise old infrastructure to meet where the market is heading.

That’s why the real innovation is coming from start-up syndicates and MGAs, which can build clean and modern platforms from day one.

The big brokers are also moving toward true electronic trading by developing their own systems and connecting them via APIs to carriers. “[Brokers have] said to people, if you aren't on this system, you won't see our business,” said a source.

This creates a major advantage for MGAs that can adopt modern technology quickly.

“Across the last 20 years, the market hasn’t really had structural losers – only firms whose models didn’t work,” said a source.

But the shift toward modern technology, they added, will draw a much sharper line between leaders and laggards.

Growth through cycles

After a decade of rapid expansion, the MGA sector entered this year as one of the P&C market’s most dynamic and resilient growth stories.

US MGA direct written premiums have more than doubled over the past 10 years, and the marketplace wrote between $95bn and $100bn in 2024, growing around 10%. Meanwhile overall P&C premium growth has hovered around 8%-10% between 2021 and 2024, according to Insurance Insider US’s research team.

In London, about 40% of Lloyd's premium is written on a delegated authority basis, sources said.

“It’s about who's basically got control of the premium and the premium flow, and it's the MGAs that control a lot of that, so when the carriers and the reinsurers are looking for beachheads into distribution, they now lean into the MGA model.”

The current MGA growth cycle has also spurred the emergence of an increasing number of MGA hosting platforms, including incubators which help to launch MGAs in a highly competitive market.

“We’re constantly being approached by risk capital looking to support MGAs,” said a source at an MGA incubator platform. They noted many capital partners are still unsure how best to position themselves in the space: whether to build their own MGA, take an equity stake, pursue a traditional delegated-authority arrangement or adopt a blend of all three.

The proliferation of these platforms points to the sector’s maturity, signalling an ecosystem expanding faster than traditional models can support.

Softening market dynamics

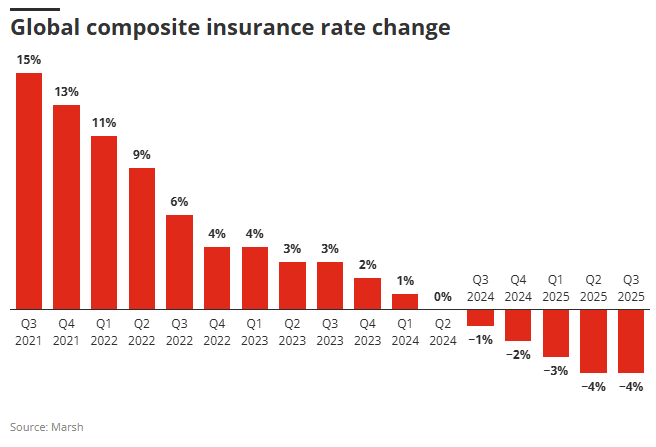

Now, after this rapid MGA build phase, the growth outlook in commercial lines is deteriorating globally with rates in most areas softening, and this market turn is driving more reinsurers to allocate capacity to MGAs as a way of trying to bring in new business.

Global commercial insurance prices fell by 4% on average during Q3 due to competition among insurers and favourable reinsurance pricing, repeating the 4% decline recorded in Q2, according to Marsh.

Amid this softening environment, sources said that reinsurers have opened the taps further to MGAs in a bid to get more business.

“Reinsurance carriers will be worried about recurring revenues, but one way to get that is to hitch your wagon to a bit more distribution,” a source said.

This is being assisted by growth in the UK market of fronting entities, who have now “come into the fore far more so than they've ever done”, a source said.

This is a relatively new development compared to the US, where fronting carriers have long driven MGA premiums.

This is a relatively new development compared to the US, where fronting carriers have long driven MGA premiums.

But servicing this growing appetite is not easy. A source said the challenge is acute for MGAs, especially if they are focused on one region or line: “If all they do is operate in the UK and insure UK customers, the new business flow just isn’t there.”

And with pricing moving down, “they still have to grow the top line, so they need to find a way to fill that gap”.

Part of the pressure stems from PE-backed MGAs chasing multi-year growth targets that they’re now struggling to hit.

As MGAs take on a larger role in the market and face pressure to meet growth targets in a softening environment, sources said they are increasing their line sizes and taking on bigger, multinational corporate accounts.

A shift toward platform structures and deeper alignment

What was once a collection of standalone MGAs is rapidly evolving into a platform-driven model, as firms recognise they can scale faster by building multi-cell structures and pursuing M&A alongside organic growth.

Multi-cell and incubator-style structures are set to become increasingly prominent as the MGA market continues to bifurcate, according to a report by Lexicon Associates.

A growing theme within multi-cell platforms is the shift toward deeper equity alignment.

The old model – where cell owners are rewarded only in their cell while the parent company owns part of the cell but has its own equity – is losing traction, as underwriters don’t participate in the upside if the parent company gets sold, according to sources.

By contrast, the new generation of platforms is “trying to create alignment, complete alignment, by earning out the cell members into the parent company”, a source said.

“It may not be as powerful an enrichment tool for the people who own the parent company, but it sure as hell creates a better alignment and life.”

Taken together, these structural forces have reshaped the MGA sector into something far more cycle-resilient than it once was. MGAs are no longer dependent on soft markets for growth, nor on carriers for expansion capital.

Instead, they sit at the intersection of specialist underwriting, technology, investor appetite and distribution access giving them a momentum that runs beyond the market cycle.

While this decoupling does not insulate MGAs from the challenges of a softening environment, it does suggest the MGA model has entered a phase of maturity where its relevance will be determined less by market conditions and more by the autonomous strategic decisions of those who operate it.

By Ayesha Venkataraman

December 12, 2025

More from the blog

View All Posts

Twelve Securis launches insurance credit fund focusing on RT1 notes

Read More

Broker stocks fall from five-year highs and multiples compress as the cycle turns

Read More